Santo Tomas Project Overview

Santo Tomás hosts a large, outcropping porphyry copper deposit comprised of fracture-hosted and disseminated Cu and Mo sulphides with significant Au and Ag credits. The Project lies within the Laramide Belt, a NW-SE trending copper belt extending from southwestern USA into southern Mexico that includes numerous world-class copper deposits, including the Cananea district, which hosts one of the largest copper deposits in the world.

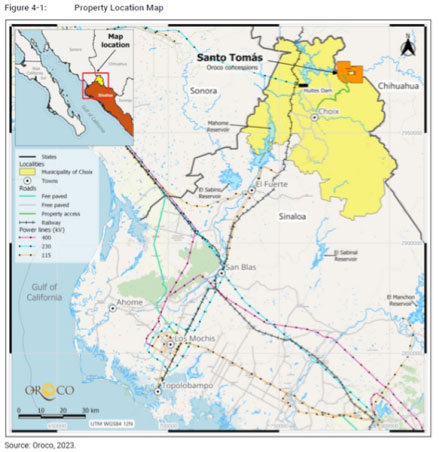

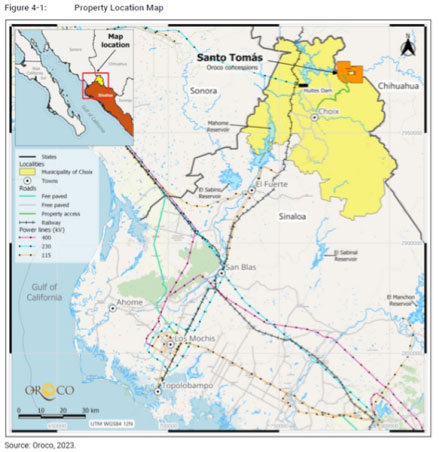

Oroco’s Santo Tomás Project is located at low elevation in the municipality of Choix adjacent to the Fuerte River, in the western Sierra Madre mountain range. The project straddles the border between the Mexican States of Sinaloa and Chihuahua. Santo Tomás is situated within the infrastructure rich “La Entrada al Pacífico,” a multi-modal transport and trade corridor recognized by the US and Mexican federal governments. Proximal infrastructure includes the deep-water port of Topolobampo, located 160km to the south-west, connected by sealed roads, a rail line, high voltage power supply, and a high-pressure gas pipeline, all within 20km or less of Santo Tomás. The region is home to numerous mining operations and has a strong regional mining culture and highly supportive local community.

Preliminary Economic Assessment (PEA)

In August 2024, Oroco announced a revised Preliminary Economic Assessment ("PEA") and updated Mineral Resource Estimate ("MRE") for the North Zone and South Zone of its Santo Tomas Porphyry Copper Project (“Santo Tomas” or the “Project”) in Sinaloa State, Mexico. This announcement builds on Oroco's April 2023 MRE and October 2023 maiden PEA. The updated PEA outlines a staged open pit operation starting at 60,000 tonnes per day ("t/d") in Year 1, year 8 over a 22.6-year Life of Mine (“LOM”). Production is preceded by two years of construction and pre-stripping. The PEA has been prepared by Ausenco Engineering USA South Inc. (“Ausenco”). The updated MRE and geologic model were prepared by SRK Consulting (U.S.), Inc. of Denver, Colorado and SRK Consulting (Canada) Inc., Vancouver, BC (jointly “SRK”). SRK (Canada) was responsible for geotechnical modeling. The mine planning and mine costs components of the PEA were prepared by SRK (U.S.).

Highlights of the revised PEA include:

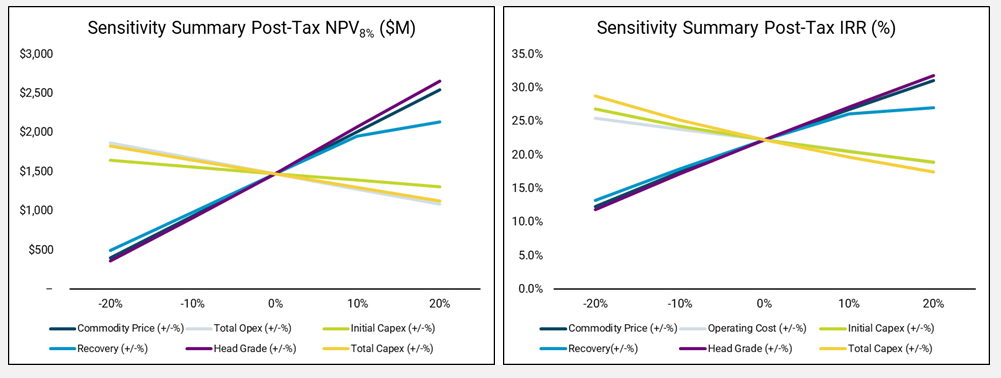

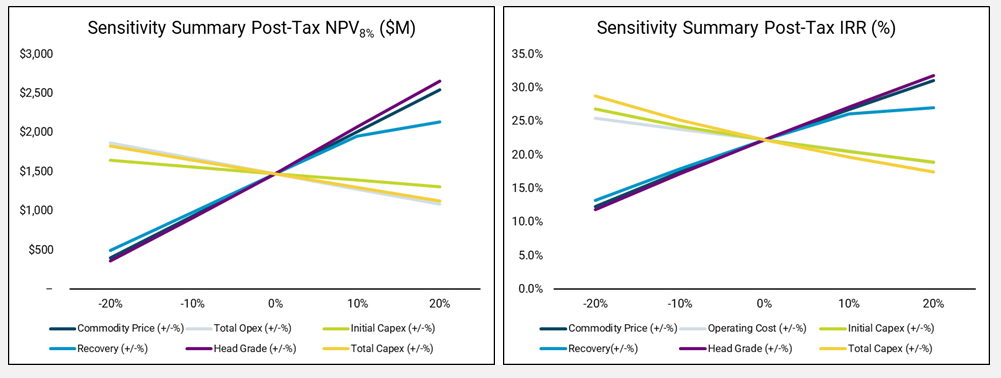

- NPV (8%) of US$2.64 billion pre-tax and US$1.48 billion post-tax.

- IRR of 30.3% pre-tax and 22.2% post-tax.

- Total LOM payable copper production of 4,774 M lb.

- Pre-tax payback of 2.9 years; post-tax payback of 3.8 years from first concentrate production.

- Initial capital costs estimated at US$1,103.5 million; sustaining and expansion capital costs estimated at US$1,734.1 million.

- Annual LOM C1 Cash Cost of US$1.54/lb Cu on by-product basis.

- Average CuEq grade of 0.51% over the first 7 years of production.

- Capital efficiency ratio (NPV / Initial Capital Cost) of 1.34.

- Total mineralized material mined of 825.5 Mt.

Commenting on the updated PEA, CEO Richard Lock:

“When we completed the initial PEA in December 2023 it was clear there was additional value to be unlocked at Santo Tomas. Upon careful analysis, a staged approach to the mine expansion and a focus on exploiting the higher-grade near surface material in the early years of mining has unlocked a considerable increase in value. We have established a plan that invokes a very efficient use of capital and establishes a rapid post-tax payback of 3.8 years. The plan starts with the use of smaller equipment to provide rapid entry to the mineralized material and maintains a higher-grade feed profile to delay the requirement of an expansion until year 8. Copper Equivalent production in the first 7 years is forecast at 1.34 billion pounds at a Mill Feed average grade of 0.51% Cu Eq.

Figure 1: Post-Tax NPV and IRR Sensitivity Plots

Project Enhancement Opportunities

Several further opportunities to improve the Project have been identified during the revised PEA Study. These include but are not limited to:

- Infill resource drilling in the area between North and South zones: additional resource in that area would improve optimized pit development and reduce mining costs.

- Acquire ROM size distribution curves and perform additional comminution studies and variability testing to better constrain recoveries across the full range of expected mill feed grades based on rock and alteration types.

- Consider a flying belt conveyor design from primary crusher to the mill feed stockpile.

- Investigate coarse particle flotation to reduce comminution costs and improve factors of safety on TSF design.

- Drill hydrogeological test wells at the north end of the North Pit to better define seepage rates into the pit, well-field design and permitting requirements associated with groundwater pumping.

- Drill selected geotechnical holes to optimize pit slope angles and reduce mining of waste.

- Optimize heavy equipment leasing terms.

- Initiate environmental baseline studies.

- Complete a trade-off study to compare the operating costs associated with electric drills and shovels to the costs to operate diesel-powered units. Include the impact on power supply infrastructure for the former.

- A detailed pioneering road design to the starting benches of every phase is recommended to better determine the number of tonnes required to be moved using a small fleet.

- Evaluate the trade-off between buying and maintaining a fleet of smaller pioneering equipment and contracting all pioneering work to a third-party.

- One or more iterations of pit design are recommended to minimize overall LOM stripping while still focusing on reducing the quantity of pre-stripping required.