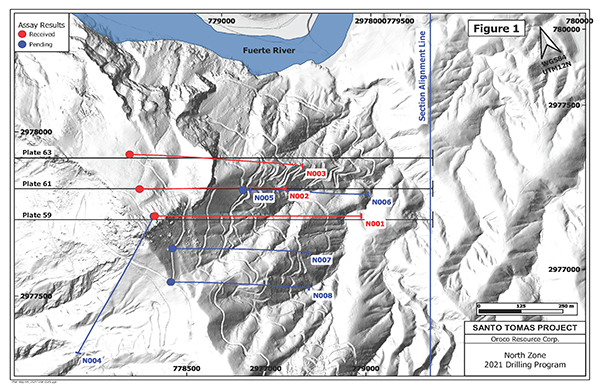

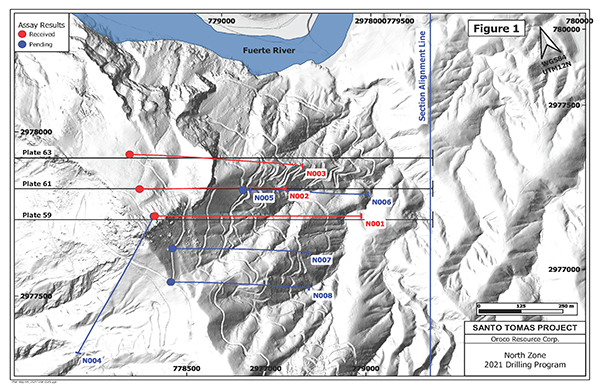

VANCOUVER, British Columbia – (December 9, 2021) Oroco Resource Corp. (TSX-V: OCO, OTC: ORRCF) (“Oroco” or “the Company”) is pleased to announce the receipt of the assay results from its initial drilling campaign at its Santo Tomas property (the “Property”) in northwestern Mexico. Eight drill holes have been completed to date, all in the North Zone (see Figure 1, attached). An additional two drill holes in the North Zone are completed, pending surveying. A further two drill holes are in progress in the North Zone, and another in the Brasiles Zone. Assays reported herein are for the first three holes (N001 to N003) comprising 2,350m of HQ3 and NQ3 diameter diamond drilling which produced 1,492 assay samples.

The Company is very pleased that the initial drilling results confirms the following:

- Copper grades in holes N001 to N003 are comparable to the historical drilling reported on each of the cross-sections drilled to date.

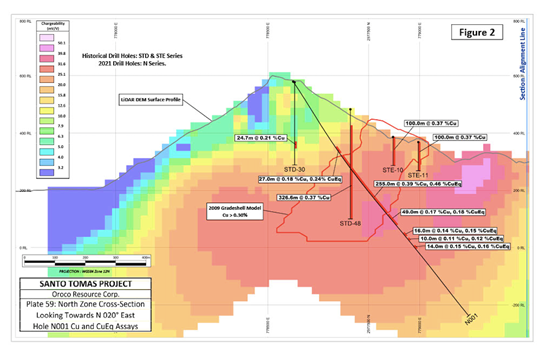

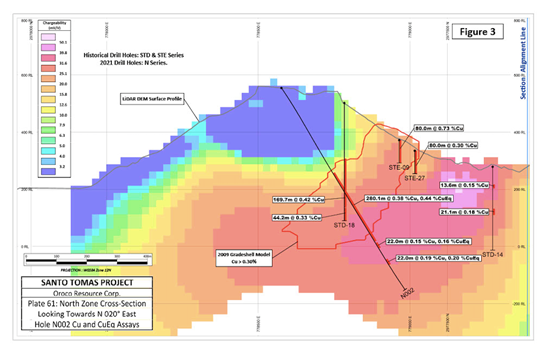

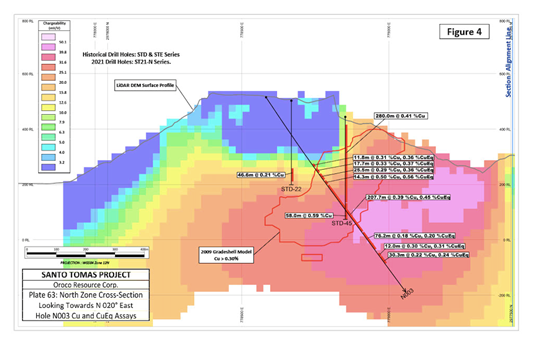

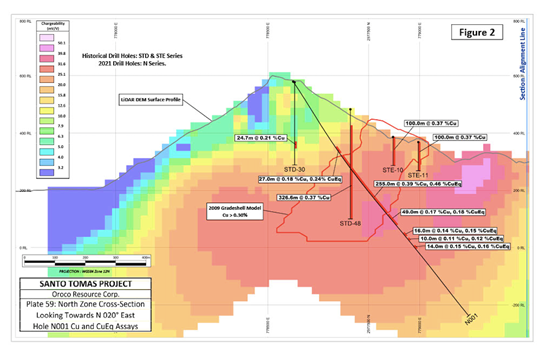

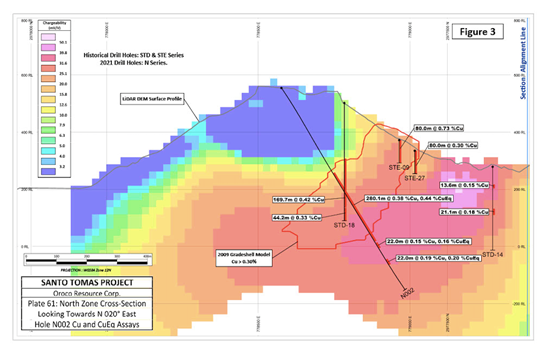

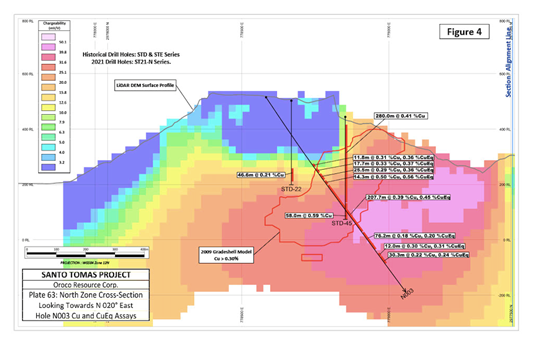

- Drilling results in N001 to N003 conform closely to, and confirm the geological conclusions and the 2009 Gradeshell model of Cu > 0.3% (the “2009 Gradeshell Model”) contained in the current Technical Report (‘the “Technical Report”) (Bridge, 2019: See SEDAR, or the Company’s website www.orocoresourcecorp.com/projects/technical-reports/). (see Figures 2, 3 and 4, attached).

- Geological logging indicates copper is present as chalcopyrite and bornite dissemination and vein fillings. Pyrite is relatively sparse in the main drill intersections.

- Molybdenum, gold and silver are elevated across the width of the North Zone and provide about a 15 to 20% contribution to the copper equivalent grade, without factoring for metallurgical recoveries.

- Fracturing, Laramide intrusive dikes, mylonite zones, veining and sulphide mineralization are controlled by faulting co-eval with the formation of the North Zone deposit. The deposit is confirmed in drilling with a strike of N20°E and a dip of 50-55°W, as reported in the Technical Report.

- Sulphide mineralization in the main intersections on the North Zone are hosted in strongly potassic-altered volcanic and intrusive rocks with an overprint of phyllic alteration.

- The footwall of the North Zone is propylitic-altered andesite volcanic rock with disseminated and vein filling pyrite, explaining the extreme Chargeability High response in the 3D IP survey.

The Santo Tomas Cu-Mo-Au porphyry deposit is an example of the geologic style of Laramide-age porphyry copper deposits in the southwestern United States and northwestern Mexico. Historical Pre-Feasibility Studies, recent 3D modelling of historical drilling, and several new programs of geophysical surveying have defined drill targets, both for confirmation of historical mineral resource estimates and for exploration for additional resources.

The 2021 drill program commenced on the central North Zone mineral deposit to confirm historical drill results and the Company’s geological modelling, and has now spanned 500 m of strike length on the North Zone. Historical drilling spanning 1968 to 1994 was primarily vertical and unsuited to defining the full width and depth of the North Zone. The 2021 program is based on angled drill holes oriented perpendicular to the re-modelled strike and dip of the deposit and is the first program that features drill holes that pass from the hanging wall of the North Zone deposit into the footwall and which also features a full suite of assay information that includes copper, molybdenum, gold and silver.

Table 1 contains the most significant intervals in drill holes N001 to N003. Core intervals in this disclosure are within 10% of the estimated true thickness. The Copper Equivalent (%) grade is presented for geological comparisons only within this program and was calculated based on the three-year average of commodity prices with no factoring for metallurgical recoveries, which are not yet known. Silver is noted in Table 1 but not included in the copper equivalent grade calculation. The attached cross-sections depict all core intervals in N001 to N003 exceeding 10m core length of Cu > 0.10%.

Table 1: Significant Assay Intervals in the Santo Tomas 2021 Program, DDH N001 to N003.

| Drill Hole No. |

From

(m) |

To

(m) |

Length

(m) |

Cu % |

Mo % |

Au g/t |

Ag g/t |

CuEq % |

| N001 |

310.0 |

565.0 |

255.0 |

0.39 |

0.010 |

0.045 |

2.20 |

0.46 |

| “ |

571.0 |

620.0 |

49.0 |

0.17 |

0.003 |

0.007 |

1.31 |

0.18 |

| N002 |

349.9 |

630.0 |

280.1 |

0.38 |

0.012 |

0.025 |

2.85 |

0.44 |

| N003 |

295.0 |

306.8 |

11.8 |

0.31 |

0.009 |

0.014 |

2.85 |

0.36 |

| |

315.3 |

333.0 |

17.7 |

0.33 |

0.008 |

0.017 |

1.49 |

0.37 |

| “ |

339.0 |

364.5 |

25.5 |

0.29 |

0.015 |

0.020 |

2.81 |

0.36 |

| “ |

370.0 |

384.3 |

14.3 |

0.50 |

0.008 |

0.026 |

3.33 |

0.56 |

| “ |

390.0 |

597.7 |

207.7 |

0.39 |

0.014 |

0.019 |

2.81 |

0.45 |

| “ |

601.8 |

678.0 |

76.2 |

0.18 |

0.002 |

0.007 |

2.53 |

0.20 |

Cu Equivalent (CuEq) % = Cu % + (Mo %*3.75) + (Au ppm*0.752) The commodity prices (3-year Average) used are in $US: Cu $3.20 /lb, Mo $12.00 /lb, and Au $1, 650.00 /troy oz. Ag was not used.

Initial drilling results confirm the 3D IP modelling of the deep penetrating Dias Geophysical Induced Polarization Survey completed in early 2021. A broad Chargeability High (> 15.8 mV/V) anomaly coincides with the North Zone mineral deposit and its flanks. Drilling of holes N001 to N003 confirms that the dip of the 2009 Gradeshell Model and the edge of the Chargeability High in the 3D IP are closely co-incident and reliable guides for the drilling program. The anomaly passes the 600m depth limit of the 3D IP survey, indicating a broad zone of drilling targets at depth below the limit of the Gradeshell Model.

Additionally, drilling confirms that the North Zone is comprised of intensely fractured, potassic- and phyllic-altered andesite volcanics and Laramide-age porphyritic intrusive dikes. Elevated Mo, Au and Ag accompany copper assays along the central axis of the North Zone. Pyrite is relatively low in the core of the North Zone, explaining the IP response that is in the mid-range of the Chargeability High responses on the Property. In contrast, drilling into the footwall of the North Zone in N001 to N003 consistently intersected propylitic-altered andesite. The footwall contains abundantly disseminated and vein pyrite, explaining the pronounced Chargeability High and a corresponding Resistivity Low in the 3D IP modelling.

Minor footwall copper intersections in historical and recent drill holes are documented. Diamond drill hole N003 intersected the best footwall grades to date and indicates that the footwall propylitic zone is prospective for widening the North Zone at depth and northward along strike towards the Brasiles Zone.

TECHNICAL INFORMATION AND QUALITY CONTROL & QUALITY ASSURANCE

The historical drilling data employed in this current exploration program was the subject of Data Verification procedures cited in the current Technical Report. Additional drill collar verifications were performed in the current program and collar locations fit closely to the 2021 survey control. Appropriate QA/QC protocols governed geological logging, core sampling, sample preparation, analyses, and security during the current program, including quality controls with duplicates, standards, and blanks. Samples were submitted to the Mexican division of ALS Limited in Hermosillo, Mexico, for sample preparation to pulps. Sample pulps are sent to ALS Canada Ltd. in Vancouver, Canada, for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold was determined by fire assay of a 50-gram charge, or alternately, for a 30-gram charge (1 Assay ton).

QUALIFIED PERSON

Mr. Paul McGuigan, P. Geo., of Cambria Geosciences Inc., a “Qualified Person” (as defined in NI 43-101 -Standards for Disclosure for Mineral Projects) and a senior consulting geoscientist to the Company, has reviewed and approved the technical disclosures in this news release.

ABOUT OROCO:

The Company holds a net 73.2% interest in the collective 1,172.9 ha Core Concessions of the Santo Tomas Project in NW Mexico. The Company also holds a 77.5% interest in 7,807.9 ha of mineral concessions surrounding and adjacent to the Core Concessions (for a total project area of 22,192 acres). The Project is situated within the Santo Tomas District, which extends from Santo Tomas up to the Jinchuan Group’s Bahuerachi project, approximately 14 km to the north-east. Santo Tomas hosts a significant copper porphyry deposit defined by prior exploration spanning the period from 1968 to 1994. During that time, the property was tested by over 100 diamond and reverse circulation drill holes, totaling approximately 30,000 meters. Based on data generated by these drill programs, a historical Prefeasibility Study was completed by Bateman Engineering Inc. in 1994.

The Santo Tomas Project is located within 160km of the Pacific deep-water port at Topolobampo and is serviced via highway and proximal rail (and parallel corridors of trunk grid power lines and natural gas) through the city of Los Mochis to the northern city of Choix. The property is reached by a 32 km access road originally built to service Goldcorp’s El Sauzal Mine in Chihuahua State.

For further information, please contact:

Mr. Craig Dalziel, CEO

Oroco Resource Corp.

Tel: 604-688-6200

www.orocoresourcecorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact included herein, including without limitation, statements relating to future events or achievements of the Company, are forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated or implied in such statements. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these matters. Oroco does not assume any obligation to update the forward-looking statements should they change, except as required by law.