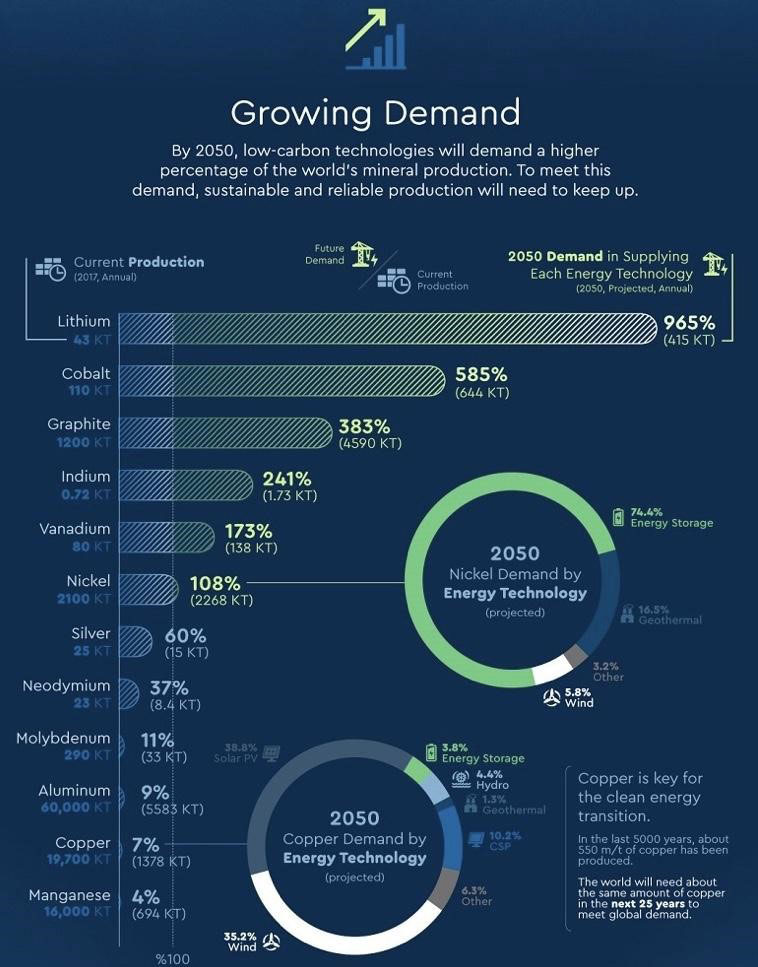

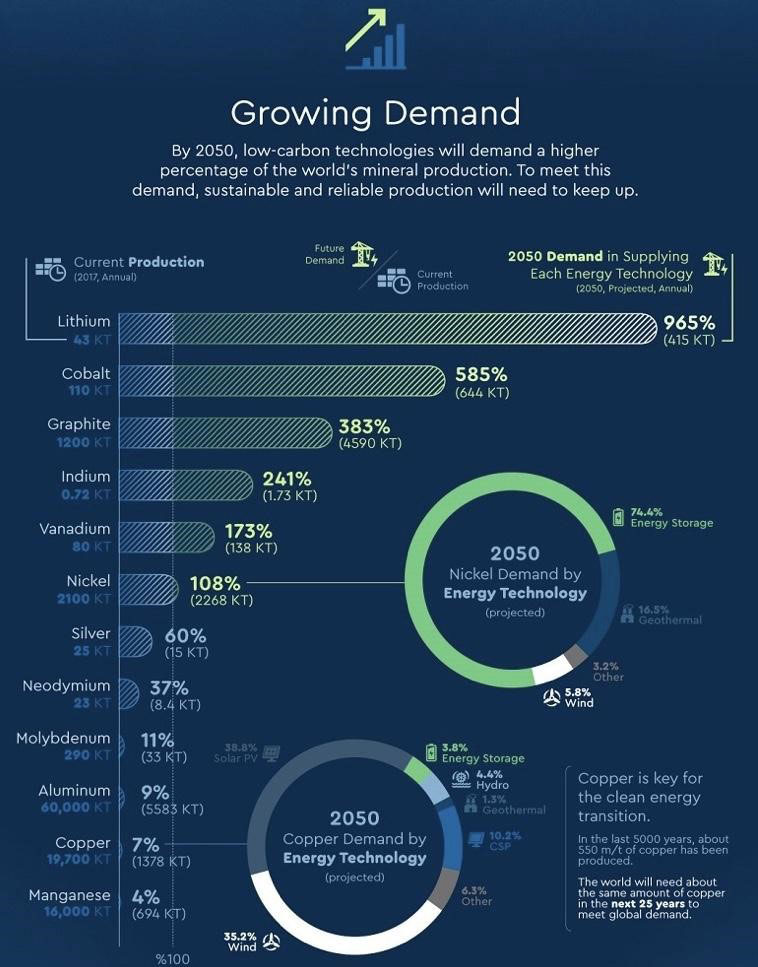

“Copper is the key for the clean energy transition”

“In the last 5000 years about 500m/t of copper has been produced.”

“The world will need about the same amount of copper in the next 25 years to meet global demand”

Source: World Bank, 2019.

Please find linked and pasted below a recent Mining.com discussing the increased demand for battery metals.

Production of battery metals such as graphite, lithium and cobalt will have to increase by nearly 500% by 2050 to meet the growing demand for clean energy technologies, the World Bank reported Monday.

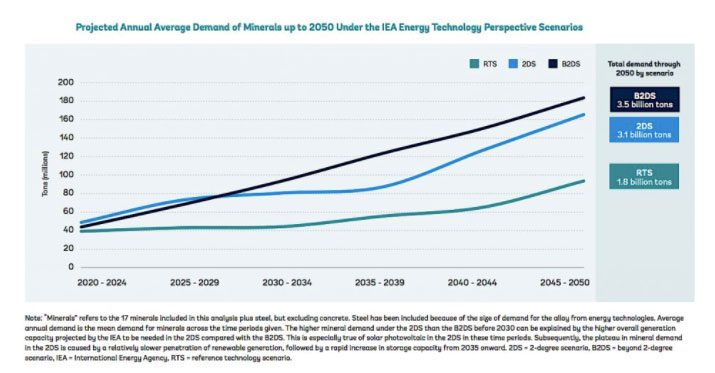

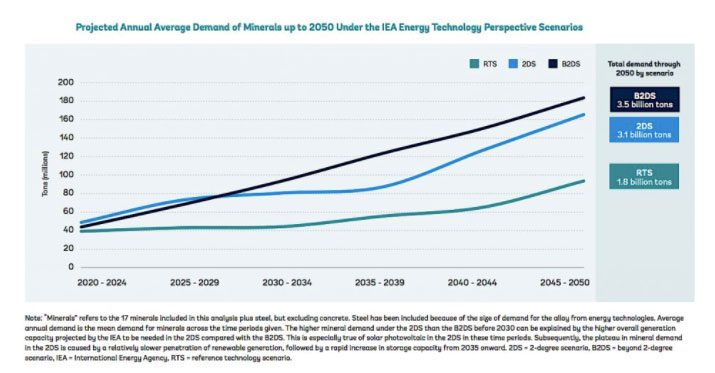

According to the global lender, over 3 billion tonnes of minerals and metals will be needed to deploy wind, solar and geothermal power, as well as the energy storage required to transition to a low-carbon economy.

Many of the critical minerals used to make batteries for electric vehicles are found in developing nations. The World Bank’s goal is to help those nations to mine those commodities in a sustainable manner to avert major ecological damage.

“MINING THE OVER 3 BILLION TONNES OF MINERALS AND METALS THE WORLD WILL NEED BY 2050 IS SEEN AS THE ONLY PATH TO LIMITING GLOBAL WARMING TO 2°C OR LESS”

Mining the vast amount of key commodities the world will need is seen as the only path to achieving the goals of the Paris Agreement. The accord seeks to limit global warming to 2°C or less.

The Minerals for Climate Action report says the world will require global carbon emissions of greenhouse gases to be reduced by 50% by 2030 and to net-zero by 2050.

The finds confirm the premise of a first report, published in 2017, which warned that the more ambitious climate targets become, the more minerals and metals will be needed.

While renewables and energy storage technologies require more minerals, the carbon footprint of their production — from extraction to end-use — will account for only 6% of the greenhouse gas emissions generated by fossil fuels.

Source: “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition” by The World Bank, 2020.

The report also calls for more recycling and reuse of minerals and notes that even if recycling rates were scaled up for minerals like copper and aluminum by 100%, recycling and reuse would still not be enough to meet the demand for renewable energy technologies and energy storage.

Virus ambush

Some minerals, like copper and molybdenum, will be used in a range of technologies while others, such as graphite and lithium, may be needed only for battery storage.

That means that any changes in clean energy technology deployments could have significant consequences on demand for certain minerals.

The lender warns of the disruptions covid-19 is causing in global markets and that developing countries that rely on minerals are missing out on essential fiscal revenues.

As their economies begin to reopen, the bank noted, they will need to strengthen their commitment to climate-smart mining principles to mitigate negative impacts.

Source: World Bank, 2019.

“Covid-19 could represent an additional risk to sustainable mining, making the commitment of governments and companies to climate-smart practices more important than ever before,” says Riccardo Puliti, World Bank Global Director for Energy and Extractive Industries and Regional Director for Infrastructure in Africa.

“This new report builds on the World Bank’s long-standing expertise in supporting the clean energy transition and provides a data-driven tool for understanding how this shift will impact future mineral demand,” Puliti says.

The World Bank’s updated predictions echo a February report by Moody’s, indicating that green, social and sustainability bond issuance is expected to hit a combined record of $400 billion just this year. That’s up 24% from the previous record of $323 billion achieved in 2019.

Source: “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition” by The World Bank, 2020.

The report also calls for more recycling and reuse of minerals and notes that even if recycling rates were scaled up for minerals like copper and aluminum by 100%, recycling and reuse would still not be enough to meet the demand for renewable energy technologies and energy storage.

Virus ambush

Some minerals, like copper and molybdenum, will be used in a range of technologies while others, such as graphite and lithium, may be needed only for battery storage.

That means that any changes in clean energy technology deployments could have significant consequences on demand for certain minerals.

The lender warns of the disruptions covid-19 is causing in global markets and that developing countries that rely on minerals are missing out on essential fiscal revenues.

As their economies begin to reopen, the bank noted, they will need to strengthen their commitment to climate-smart mining principles to mitigate negative impacts.

(continues:)

Source: World Bank, 2019.

“Covid-19 could represent an additional risk to sustainable mining, making the commitment of governments and companies to climate-smart practices more important than ever before,” says Riccardo Puliti, World Bank Global Director for Energy and Extractive Industries and Regional Director for Infrastructure in Africa.

“This new report builds on the World Bank’s long-standing expertise in supporting the clean energy transition and provides a data-driven tool for understanding how this shift will impact future mineral demand,” Puliti says.

The World Bank’s updated predictions echo a February report by Moody’s, indicating that green, social and sustainability bond issuance is expected to hit a combined record of $400 billion just this year. That’s up 24% from the previous record of $323 billion achieved in 2019.